Capital Gains and Barred Owls

In this edition of the Flying Point Update we’re going to talk about capital gains and the balance between tax efficiency and sound investing, discuss the 0% capital gains tax bracket opportunity, and learn about Barred Owls.

Top of Mind

As we enter the final quarter of the year, I've been having more conversations about capital gains than usual. It's that time when investors start looking at their portfolios and wondering whether they should sell anything before year-end, hold everything to avoid taxes, or something in between. The questions are always some version of: "Should I sell and pay the taxes, or just hold on?"

Here's the thing about capital gains taxes: they're a natural consequence of successful investing. If you have significant unrealized gains in your portfolio, congratulations - your investments did what they were supposed to do. The tax bill that comes with realizing those gains is not a problem to be avoided at all costs, it's simply the price of success.

But this is where things get tricky. Basic tax planning encourages you to delay paying taxes as long as possible. Every tax textbook will tell you that a dollar of tax paid next year is better than a dollar paid today. Meanwhile, sound portfolio management suggests you should be regularly rebalancing to maintain appropriate risk levels, taking profits on winners, and reinvesting in underweighted positions. These two principles are fundamentally at odds with each other.

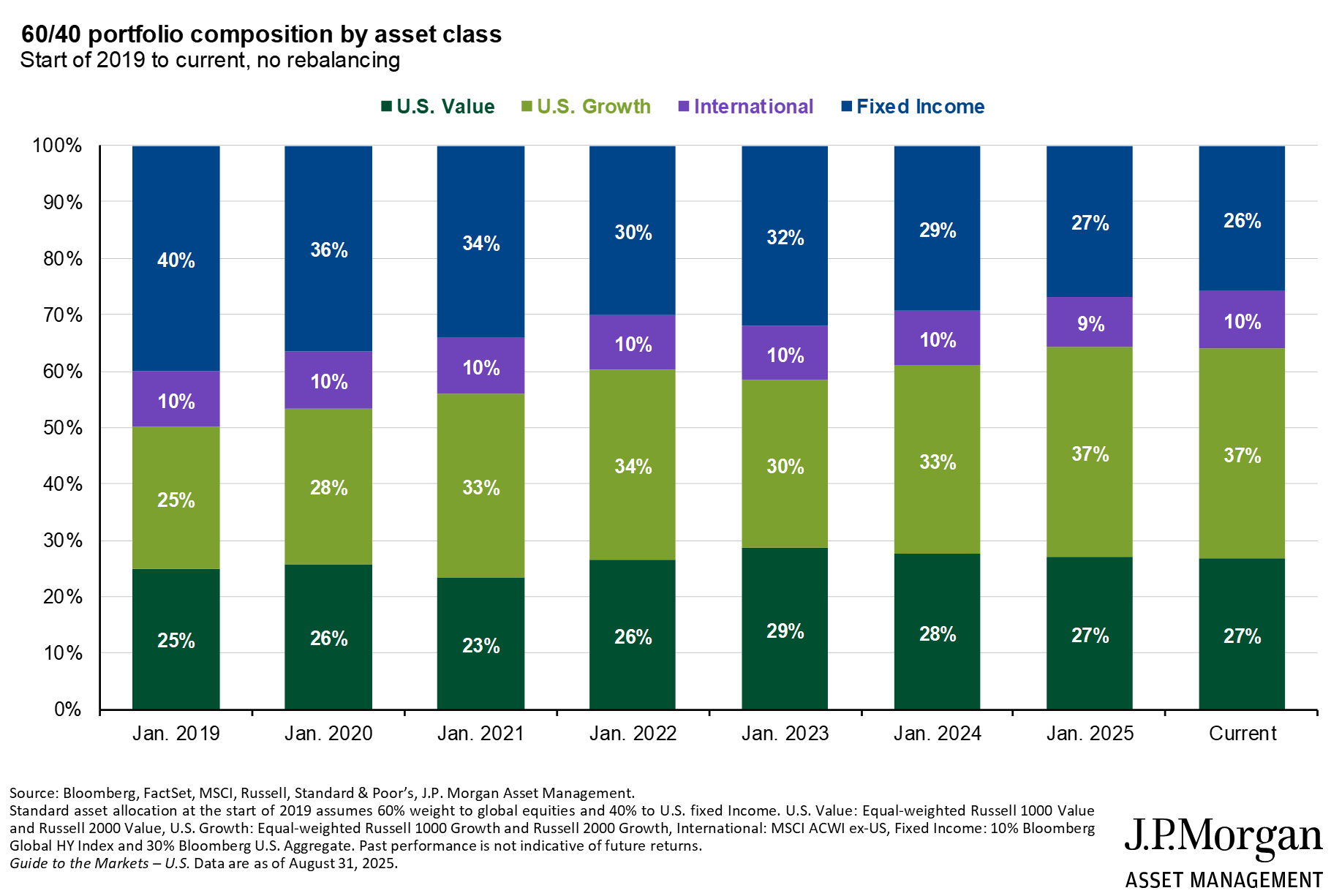

Take a look at the chart below to see what happens to a simple 60/40 portfolio when you never rebalance. A portfolio that started 2019 with a 25% allocation to U.S. growth stocks would have drifted to 37% by today without any rebalancing. Fixed income, which started at 40% of the portfolio, has shrunk to just 26%. The investor hasn't made any decisions - they've just let the winners run and avoided the tax bill. But now they're holding a fundamentally different portfolio with significantly more equity risk than they originally planned for.

Investors often hold positions far longer than they should because they don't want to pay capital gains taxes. The portfolio becomes increasingly risky, with outsized exposure to whatever happened to perform well, but the tax tail is wagging the investment dog.

The math on this is uncomfortable but important. Let's say you need to sell $100,000 of appreciated positions to rebalance properly. That might trigger $15,000 to $20,000 in long-term capital gains taxes (depending on your income level). That feels painful. But holding an unbalanced portfolio also has costs - you're taking on unintended risk, missing diversification benefits, and potentially setting yourself up for significant losses when those concentrated positions eventually correct.

There's no universal right answer here because it depends entirely on your specific situation: your tax bracket, the level of concentration, the underlying investment quality, and your overall financial plan. But the framework should be: make investment decisions based on sound portfolio management principles first, then optimize the tax consequences second. Not the other way around.

Tax efficiency matters, but it shouldn't prevent you from making smart investment decisions. Sometimes paying the tax now is the right move, even if it's painful.

Worth Knowing

While we're talking about capital gains, here's an opportunity many families overlook: the 0% long-term capital gains tax bracket. For 2025, married couples filing jointly can have up to $96,700 in taxable income and still pay 0% on qualified long-term capital gains and dividends.

This creates interesting planning opportunities, particularly for retirees or families with variable income. If you're in a lower income year - perhaps you're between jobs, taking a sabbatical, or recently retired but haven't started Social Security - you might have space in the 0% bracket to harvest gains without paying any federal tax.

The key is understanding how the brackets work. Your ordinary income (wages, interest, short-term gains, retirement distributions) fills up the brackets first, then long-term capital gains stack on top. So if you have $70,000 in ordinary income, you could potentially realize about $26,700 in long-term capital gains and still pay 0% federal tax on those gains.

For business owners with lumpy income, this might mean intentionally timing major expenses or retirement contributions to create space in the 0% bracket. For retirees, it might mean carefully orchestrating which years you take retirement distributions, start Social Security, or do Roth conversions.

The 0% bracket is a genuine tax planning opportunity, but it requires paying attention to your total income picture and being proactive about harvesting gains when you have the room.

Mark Your Calendar

October 15th: Final deadline for individual returns with extensions - the last major tax deadline until January

January 15th, 2026: Q4 2025 estimated tax payments due

This is prime time for year-end tax planning. If you've been thinking about realizing gains, harvesting losses, or making any significant portfolio changes, we should talk soon to understand the tax implications before year-end.

Maine Wild Life Facts

Will, Frank, and I have been going camping in the yard lately. Its a lot of fun. We stay up late, hang out in sleeping bags, and watch Teenage Mutant Ninja Turtles. We also get to listen for wildlife. We often get a chance to hear the distinctive call of our Barred Owl neighbors.

Barred Owls are one of the most common owls in Maine, and they're particularly vocal during late fall and winter as they establish territories. Their famous call sounds like "Who cooks for you? Who cooks for you-all?" and can carry well through the woods. Unlike many owl species, Barred Owls are comfortable calling during the day, especially on overcast days or around dawn and dusk.

What's particularly entertaining about Barred Owls is their duetting behavior. Mating pairs will perform what can only be described as a riotous conversation of cackles, hoots, caws, and gurgles back and forth to each other. If you've ever been startled by wild hooting and cackling in the Maine woods at night, you were probably listening to a pair of Barred Owls having an animated discussion.

These owls are surprisingly curious and unafraid of humans. They'll often watch you walk through the forest rather than immediately flying away, making them one of the easier owl species to observe in the wild. They prefer mature forests near water—exactly the kind of habitat that's abundant here in Maine—and they can live over 20 years in the wild.

Will has gotten quite good at imitating the call, and is desperate to get our neighbor owls to respond. It's become one of his favorite parts of our backyard camping adventures.

These Maine wildlife facts have been brought to you by Will (7) and Frank (3), Flying Point Advisors' on-staff naturalists.

Questions about any of this? Just reach out - I read every email and love hearing from you. Thanks for reading. You'll hear from me again in about two weeks.

-Mike

Disclaimer

The Flying Point Update is provided for general educational and informational purposes only. The content in this newsletter reflects my thoughts and observations on tax, accounting, and financial planning topics, but should not be considered personalized tax, accounting, or investment advice for your specific situation.

Tax laws are complex and change frequently. The information presented here is based on current tax law as of the publication date and represents general concepts that may not apply to your circumstances. Every individual and business has unique factors that affect their optimal tax and financial planning strategies.

Before making any financial decisions or implementing any tax strategies discussed in this newsletter, please consult with a qualified tax professional, CPA, or financial advisor who can evaluate your specific situation. If you'd like to discuss how any of these topics might apply to your circumstances, I'm always happy to chat.